Highlights

- Contractual terms finalised with key consultants for commencement of Mid West Blue Hydrogen Feasibility Studies,

- Key consultants engaged to conduct the feasibility studies include internationally recognised Genesis and Technip Energies, RISC, and 8 Rivers Capital,

- ARENA mandate recently expanded to support the next generation of energy technologies including clean hydrogen and carbon capture and storage.

Disclaimer: Originally published by Pilot Energy Limited (“Pilot” or “The Company”), (ASX: PGY) on 12th August 2021”. For further information, visit Pilot Energy's website.

Pilot Energy Limited (“Pilot” or “The Company”) is pleased to announce that following shareholder approval of the $8 million equity capital raise (at the Company’s General Meeting held on 4 August 2021) and reinstatement of trading in Pilot shares (refer ASX Announcement dated 11 August 2021), Pilot is now in a position to commence the Mid West Blue Hydrogen Feasibility Studies.

These include the following:

- The Mid West Blue Hydrogen and Carbon Capture and Storage (“CCS”) Preliminary Feasibility Study; and

- The Blue Hydrogen and CO2 Technology Study.

Hereinafter referred to as “the Feasibility Studies”.

As a diversified energy company, Pilot plans to leverage its existing oil and gas assets together with established energy industry infrastructure to become a leading developer of competitive clean energy projects in Western Australia. The Feasibility Studies are designed to assess blue hydrogen and carbon capture and storage projects that can integrate with existing assets and infrastructure to deliver competitive clean energy. Selected development projects identified by the studies will form the basis for future FEED studies, partnering, and other corporate initiatives.

Pilot has engaged Genesis, a wholly-owned Technip Energies company (“Genesis”), RISC Advisory Pty Ltd (“RISC”), and 8 Rivers Capital (“8 Rivers”) to assist with the Feasibility Studies to be conducted over the Mid West project area.

Note an additional study is planned for the South West region, the details of which will be announced once contractual arrangements are finalised with the relevant consultants for this study.

A summary of the Mid West and South West (Western Australia) Blue Hydrogen and CCS Feasibility Studies (including description, cost, and timing) is set out in the table below:

Feasibility StudyForecast total cash costEstimated timing

| Blue Hydrogen Studies | ||

| Mid West Blue Hydrogen & CCS study | $0.6m | Q3 FY21 – Q2 FY22 |

| Blue Hydrogen and CO2 technology study | $0.6m | Q3 FY21 – Q2 FY22 |

| South West Blue Hydrogen & CCS study | $0.6m | Q3 FY21 – Q2 FY22 |

| Total forecast cash cost | $2.1m |

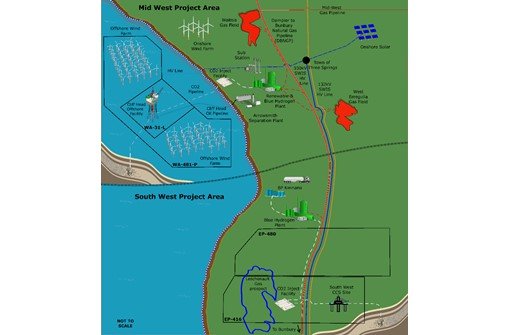

Figure 1. (right) depicts Pilot’s projects and facilities together with infrastructure that Pilot proposes to develop subject to the results of the feasibility studies. Pilot’s future projects anticipate leveraging its existing assets and resources to develop world-class clean energy projects across the Mid West and southwest regions of Western Australia. The future infrastructure projects may include, as shown above, a CO2 pipeline and injection facility, blue hydrogen plants, CCS sites, offshore and onshore wind, solar, renewable hydrogen plant, substation, transmission lines, and hydrogen pipelines.

Pilot notes the new regulations introduced in early August 2021 by the Australian Government that enable the Australian Renewable Energy Agency (“ARENA”) to support via grant funding the next generation of energy technologies. ARENA has been provided $192.5 million to deliver programs targeted in the 2020-21 Federal Budget which includes clean hydrogen and CCS. Such funding may assist with accelerating the development of clean hydrogen and CCS projects.

Pilot’s Executive Chairman, Brad Lingo noted that “the Company is now well capitalised to support its business plans to become a leading energy developer and provider of clean energy projects in WA. The commencement of the feasibility studies is an important step in confirming the Mid West hydrogen and CCS development plans.”

Overview of the Blue Hydrogen Feasibility Studies

Mid West Blue Hydrogen and Carbon Capture and Storage Feasibility Study:

The objective of the Mid West Blue Hydrogen and CCS study is to assess the carbon capture, storage, and use of the potential of the Cliff Head oil project and additional reservoirs across the broader Perth Basin, the production of blue hydrogen, and commercialisation via the provision of CO2 management services and sale of hydrogen. Two leading international feasibility contractors have been engaged to assist with the study and further external assistance may be required to complete the study.

Pilot has engaged Genesis to project manage the feasibility study and prepare the overall study report in conjunction with the Company and the other feasibility consultants. In addition, Pilot is leveraging Technip Energies’ significant hydrogen industry experience to complete an assessment of blue hydrogen production technologies and hydrogen markets.

RISC has been engaged to conduct the assessment of the infrastructure and CCS reservoirs (Cliff Head and other reservoirs across Perth Basin) associated with the proposed carbon management services and CCS activities. The team at RISC has a long history with the Cliff Head asset through involvement in the initial development through to a recent Cliff Head oil reserves/resources audit for Triangle Energy (Global) Limited and Pilot.

The forecast cost of the study is $0.6 million and the study will be conducted over a 6- month period. Key outcomes of the study will include detailed description and assessment of development projects, levelised cost of hydrogen, and CO2 management services.

Blue Hydrogen and CO2 Technology Feasibility Study:

In preparing Pilot’s submission to the WA Government’s Oakajee Strategic Industrial Area Renewable Hydrogen expression of interest, Pilot’s technical assessments 5 highlighted that a significant capacity of gas-fired generation may be required to support the development. Pilot identified 8 Rivers Allam Fetvedt Oxy Combustion technology for clean power generation as a key enabling technology in achieving a low to zero carbon emission development at Oakajee.

Pilot has engaged 8 Rivers to undertake a detailed assessment of deploying the clean power generation and 8 Rivers Hydrogen Autothermal Reforming technology for clean hydrogen production. The study will investigate the integration of these technologies across renewable hydrogen and blue hydrogen and CCS projects.

The forecast cost of the study is ~$0.9 million and the study will be conducted over a 6-month period. As part of the fee arrangements, 8 Rivers will be issued 13.3 million options (at an exercise price of $0.08 per share and with a 36-month term) to enhance the longer-term commercial alignment between the companies and partially reduce the upfront cash cost of the study. The options are subject to a voluntary escrow period aligned with the delivery of the final report.

Key outcomes of the study will include a detailed description and assessment of development projects, execution strategy (site selection and permitting), levelised cost of electricity and hydrogen. The study will also assess the integration of the 8 Rivers technology with the production of renewable hydrogen. The 8 Rivers technology requires pure oxygen, as such the study will assess the integration of renewable hydrogen electrolysis which produces pure oxygen and hydrogen into facilities using the 8 Rivers technology.

Feasibility Consultants – further information

Christophe Malaurie, Senior Vice President of Genesis, stated “We are incredibly excited to work with Pilot on this promising energy transition project for the Mid West region. It demonstrates not only our commitment to a sustainable future but is recognition of our ability to frame, assess and present the critical information to allow robust investment decision.”

Genesis is a market-leading advisory company wholly owned by Technip Energies and focused on providing technical and advisory services to the global energy industry. Located in 18 global locations, Genesis’ highly experienced teams and sophisticated tools and processes, offer robust support to our clients, helping them to de-risk projects and maximise value in their investments. Genesis is committed to being trusted advisors while delivering low-carbon solutions for a sustainable future.

Genesis and Technip Energies are at the forefront of the energy transition which provides the ability to reach out to over 15,000 employees worldwide including global subject matter experts in key areas such as Hydrogen, Sustainable Chemistry, Decarbonisation, and Carbon-Free Energies. This will provide the feasibility study with the latest up-to-date understanding of technologies from across the globe and how they can be utilised for the Mid West Projects.

Technip Energies brings quality consultancy experience, with highly regarded expertise in both the energy and hydrogen fields. It has been responsible for over 270 hydrogen production plants worldwide, which now account for more than 35% of the world’s current hydrogen production, and has recently launched BlueH2 by T.ENTM, a full suite of deeply decarbonised and affordable solutions for hydrogen production able to reduce by up to a 99% the carbon footprint compared to the traditional hydrogen process.

RISC has supported the energy industry for over 25 years, providing independent and impartial advice to investors in energy projects around the world. RISC’s highly skilled multi-disciplinary teams are routinely deployed for complex due diligence in support of acquisitions and divestments and regularly work to tight timeframes. In the past 5 years they have supported over $20 billion of transactions, including some of the largest in Australia. Their advice is trusted by the principal lenders to the industry and many ASX listed firms use them as their annual reserve auditors. RISC's regional and global coverage enables them to provide a unique, balanced and holistic perspective to all the projects they are involved with. RISC’s advice combines commercial and technical recommendations enabling their client to make business decisions with confidence.

RISC has a long history with Cliff Head, and RISC staff were involved in the initial development by ROC oil, carrying out a number of reviews between 2004 and 2006 (when the field started up). They were the principal reserves auditor for the field until 2017 and have recently audited the field for Triangle Energy (Global) Limited and Pilot. RISC’s experience includes miscible gas floods, natural gas storage developments (they have experience of all Australian gas storage projects), Carbon Capture and Storage, and key features of the emerging hydrogen economy. They can support projects from concept through to delivery providing a long-term technical partner that will add credibility to the future plans for Cliff Head.

8 Rivers is a clean energy technology developer, solutions aggregator, and project developer. 8 Rivers’ carbon capture technologies across the power, hydrogen, and direct air capture spaces have attracted in excess of $200 million of private and public investment to support their engineering, demonstration, and commercialisation.

8 Rivers’ 8RH2 technology can produce zero-emissions hydrogen and ammonia at strongly cost-competitive price points. Building on its experience in zero-carbon technologies, 8 Rivers has a robust project development engine - Zero Degrees Developments - specialising in early-stage energy-transition projects, including three recently announced projects: Whitetail Clean Energy, the Coyote Clean Power Project, and the Broadwing Clean Energy Complex. 8 Rivers, with its strong technology portfolio and extensive experience in clean energy projects development, is excited to be a part of industry-leading set of feasibility studies that Pilot Energy has set forth.

This announcement has been authorised for release to ASX by the Chairman Brad Lingo and Managing Director Tony Strasser.

Get in touch

If you require more information, please contact your local Genesis representative.