In recent years, businesses have found themselves under increasing scrutiny regarding their Environmental, Social and Governance (ESG) performance. This growing attention stems from a convergence of market pressures, evolving stakeholder expectations, and an ever-changing web of regulatory requirements. As the global community grapples with the pressing challenges of climate change, biodiversity loss and social equity, the bar for corporate accountability has been raised. Organisations are now expected not only to meet compliance standards, but also demonstrate proactive leadership in addressing these critical issues.

Rising Expectations for ESG

The regulatory landscape for ESG has become particularly dynamic with new legislation, standards and frameworks emerging across jurisdictions to tackle a broad spectrum of environmental and social challenges. Since the landmark Paris Agreement in 2016, climate-related legislation has surged, reflecting the urgency of addressing greenhouse gas emissions and achieving net-zero targets. Businesses have responded by implementing strategies to reduce their carbon footprints driven by a combination of regulatory mandates, investor demands and consumer expectations. However, the focus is now expanding beyond climate change to encompass a broader range of nature-related considerations, signalling a pivotal shift in the ESG agenda.

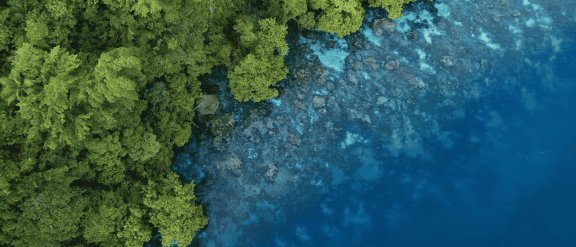

The Shift Toward Nature-Positive Action

A major milestone in this evolution was the adoption of the Global Biodiversity Framework in 2022 by 196 countries. This agreement underscored the global commitment to tackling nature loss and degradation alongside climate change, recognising these issues are deeply interconnected. The framework marked a turning point, urging businesses and governments alike to adopt a more holistic approach to environmental stewardship. Building on this momentum, the Taskforce on Nature-related Financial Disclosures (TNFD) released its recommendations in 2023. These guidelines aim to help organisations identify, assess and manage nature-related risks, providing guidance for integrating biodiversity into business strategies.

The concept of being "nature-positive" has since gained traction with 2024 seeing the introduction of groundbreaking legislation in the UK, Australia and the European Union. These laws encourage businesses to actively contribute to the restoration and preservation of natural ecosystems, going beyond harm reduction to create net-positive impacts on biodiversity. As more countries are expected to follow suit, the nature-positive movement is poised to become a cornerstone of global ESG practices in the coming years.

Practical Guidance for Businesses

Genesis has published a paper in the Australian Energy Producers Journal. The paper draws on our extensive experience working with energy sector clients to offer practical guidance for businesses navigating this rapidly evolving landscape. It provides actionable recommendations for identifying nature-related risks and opportunities, emphasising the importance of embedding biodiversity considerations into operational and strategic decisions. By doing so, organisations not only can mitigate potential risks but also unlock new opportunities for innovation, resilience and long-term value creation.

One of the key challenges highlighted in the paper is the need for a systematic approach to managing nature-related performance. This involves aligning with existing disclosure requirements while maintaining the flexibility to adapt to future regulatory changes. The authors outline several critical aspects to consider, including the integration of nature-positive principles into corporate governance structures, the development of robust metrics for measuring biodiversity impacts, and the importance of transparent reporting to build trust with stakeholders.

The paper also emphasises the interconnectedness of climate and nature-related issues, advocating for a unified approach that addresses both challenges simultaneously. For example, restoring degraded ecosystems can serve as a natural solution for carbon sequestration, while protecting biodiversity can enhance the resilience of supply chains to climate-related disruptions. By adopting such integrated strategies, businesses can position themselves as leaders in the transition to a sustainable and equitable future.

Ultimately, this paper serves as a call to action for businesses to embrace the nature-positive agenda as an opportunity rather than a burden. As the regulatory and societal expectations around ESG continue to evolve, organisations that proactively address nature-related risks and opportunities will be better positioned to thrive in a rapidly changing world. By aligning their operations with the principles of sustainability and biodiversity preservation, businesses can not only meet compliance requirements but also contribute meaningfully to the global effort to safeguard our planet for future generations.

Read the full article published in the CSIRO PUBLISHING | Australian Energy Producers Journal: Moving beyond climate to nature-focused operations.

Get in touch

Contact us

If you require more information, please contact your local Genesis representative.